Финансовые технологии

After learning about trading beforehand, the only thing left to do is to make your first trade on our live platform. However, if you still want to know more about entering the world of trading, read our How to get into trading page https://histor-ru.ru/wp-content/pgs/chto-takoie-ts-upis-v-biet-bum-prostymi-slovami.html.

Step 6: Place your order. Once you’ve identified a suitable trading opportunity, place your order through the trading platform. Choose the appropriate order type (e.g., market, limit, or stop), specify the quantity, and set any applicable stop-loss or take-profit levels to manage risk.

The course takes about four hours to complete, and it covers a lot of topics. Because of its online format, you have one year to watch the course as often as you’d like. You can start and stop the course when you need to and pick up right where you left off—all at your convenience.

A pattern day trader (PDT) is a classification given by the U.S. Securities and Exchange Commission (SEC) to traders who execute four or more “day trades” within five business days using a margin account. A “day trade” is defined as buying and selling the same security on the same day.

Support for popular payment systems

Aggregators are universal platforms that combine several payment methods in one service, allowing businesses to offer a wide range of options to customers. Such systems are convenient for companies looking to reduce the costs of connecting different payment solutions and offer a more comprehensive solution to customers.

Fondy is an international payment platform that supports more than 300 payment methods. Among them are Visa, Mastercard, Apple Pay, Google Pay, as well as local payment methods in various countries, which allows the company to work with a wide audience around the world. A special feature of Fondy is the software RPO, which allows issuing fiscal receipts without a physical cash register, which simplifies reporting and complies with legal requirements. Fondy also actively cooperates with charitable foundations, offering them the opportunity to receive donations without commission. This makes the platform attractive to non-profit organizations that need support for a large number of payment methods and the convenience of fundraising.

Offering a variety of payment options can help businesses increase sales, but it’s important to understand the costs involved. Each payment method comes with its own set of fees, which can significantly affect your profit margins over time.

Aggregators are universal platforms that combine several payment methods in one service, allowing businesses to offer a wide range of options to customers. Such systems are convenient for companies looking to reduce the costs of connecting different payment solutions and offer a more comprehensive solution to customers.

Fondy is an international payment platform that supports more than 300 payment methods. Among them are Visa, Mastercard, Apple Pay, Google Pay, as well as local payment methods in various countries, which allows the company to work with a wide audience around the world. A special feature of Fondy is the software RPO, which allows issuing fiscal receipts without a physical cash register, which simplifies reporting and complies with legal requirements. Fondy also actively cooperates with charitable foundations, offering them the opportunity to receive donations without commission. This makes the platform attractive to non-profit organizations that need support for a large number of payment methods and the convenience of fundraising.

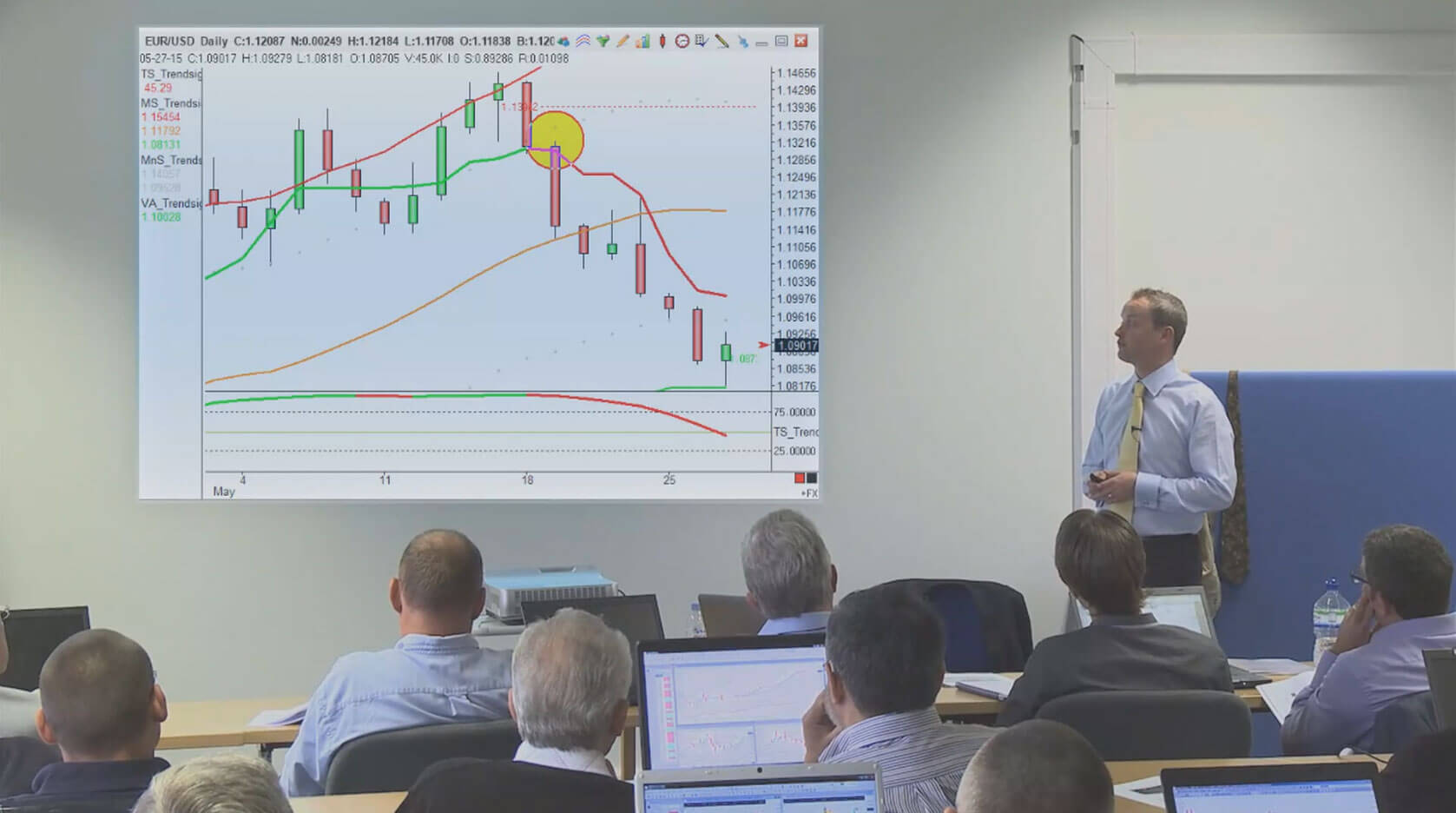

User-friendly interface for traders

The aforementioned testimonials are made by individual subscribers to Trade With the Pros services. The experience of these individuals may not be representative of the experience of other subscribers, like yourself. In addition, the aforementioned testimonials do not guarantee future success by using such services. No consideration was paid to the individuals that submitted these testimonials.

M1 Finance combines automated investing with high customization and has an intuitive design on both desktop and mobile. The platform’s layout is user-friendly, visualizing portfolios through easy-to-understand pie charts. Users can create custom portfolios or choose from pre-built expert pies.

Interactive Brokers (IB) is designed for serious traders, so it’s more focused on offering a rather deep and sophisticated platform. The interface, while complex, is organized and efficient, providing access to a wide range of advanced trading tools.

When comparing platforms, look beyond the advertised rates. Consider the full range of services offered, execution quality, and customer support. It’s like choosing a restaurant – sometimes paying a bit more for better quality and service is worth it.